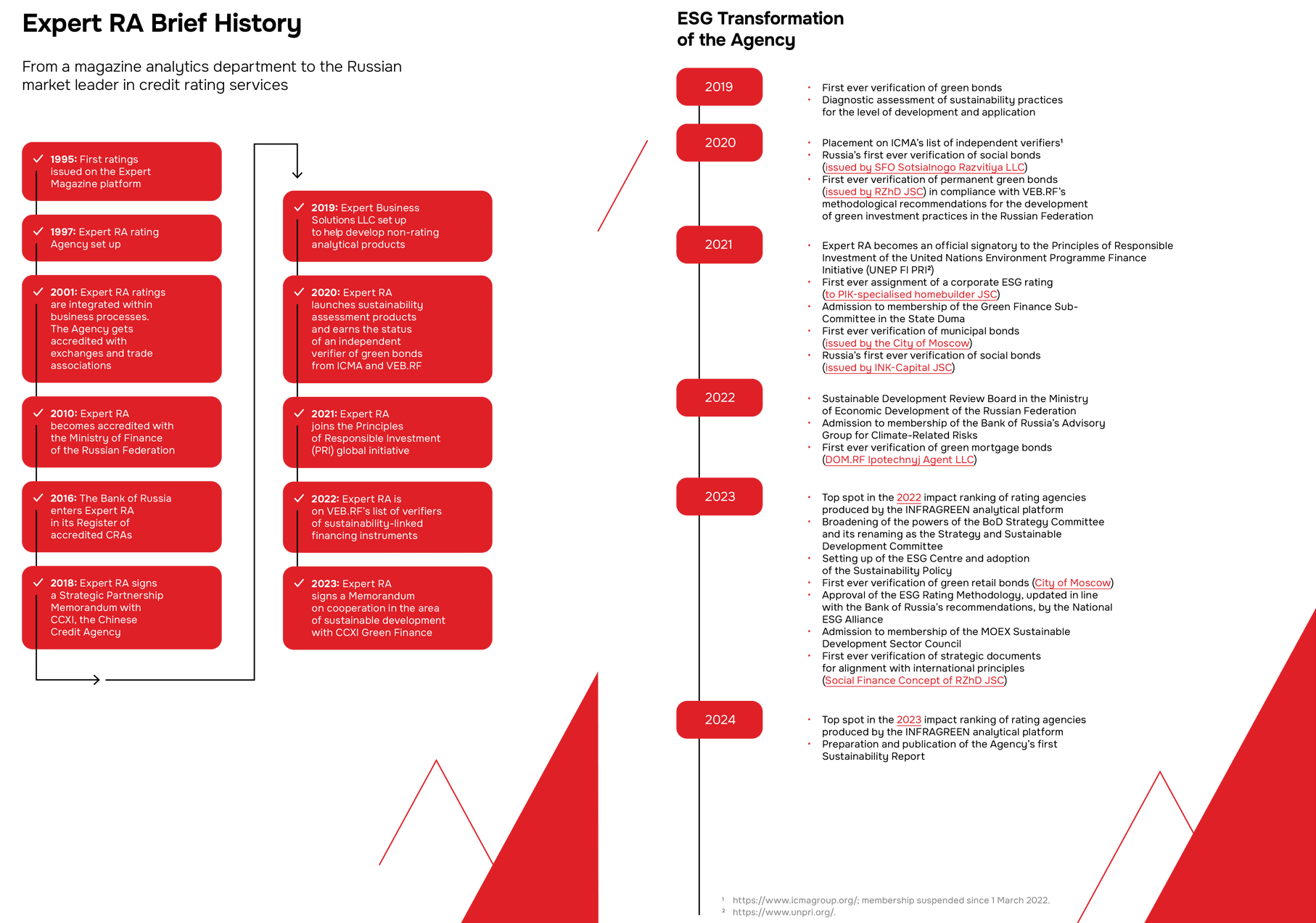

Largest Credit Rating Agency with a 25+ Years History

GRI: 2-6

Our mission is to be a confidence institution that links together the businesses, the government and the society by providing expertise for decision-making.

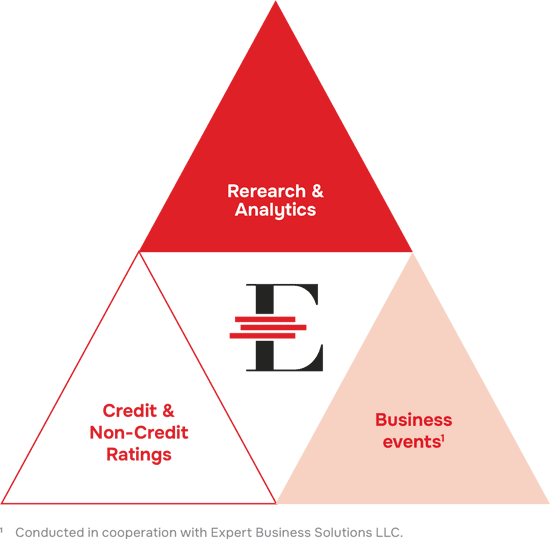

Set up in 1997, Expert RA is currently Russia’s oldest and largest credit rating agency by both customer base and number of employees.

Assigning credit ratings has been Expert RA’s core business for 27 years. Expert RA is not only a market leader in credit rating services, but also a high-profile analytical centre in Russia.

Being rated by Expert RA is among the official requirements imposed on banks, insurers, pension funds, and issuers. The Agency’s ratings are used by the Bank of Russia, the Ministry of Finance of the Russian Federation and the Ministry of Economic Development of the Russian Federation, Moscow Exchange (MOEX), and by hundreds of companies and government agencies in their tender and bidding processes.

Expert RA is in the Bank of Russia’s Register of Credit Rating Agencies and is also listed as an independent verifier of green and social bonds by the International Capital Market Association (ICMA) ICMA suspended the membership of Russian participants on 1 March 2022. , MOEX and VEB.RF.

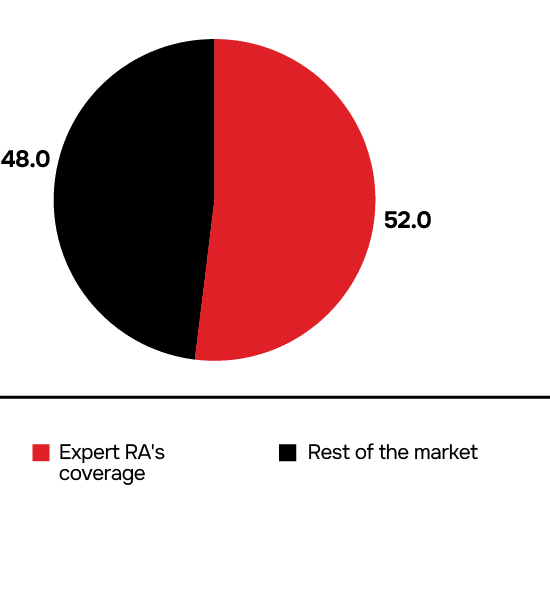

Expert RA is Russia’s market leader in credit rating services

At year-end 2022, Russian credit rating agencies (CRAs) rated 757 entities, most of which were covered by Expert RA. According to the Bank of Russia, Expert RA accounts for more than 50% of ratings assigned in the Russian credit rating market.

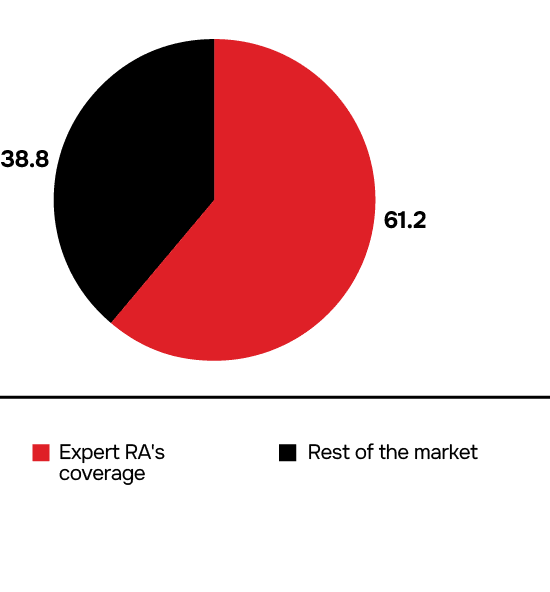

According to our sources, at year-end 2023, there were 790 rated entities in Russia, of which 484 (61.2%) were Expert RA’s customers.

Expert RA Organisational Structure

Expert RA structure includes analytical, technology and operations organisational units, as well as units independent from the Rating Service (such as the Methodology Department and the Validation Department).

The analytical organisational units include:

- Macroeconomic Analysis and Forecasting Department

- Rating Service, which, in turn, consists of six departments, viz., Credit Institution Ratings, Corporate Ratings, Insurer & Investment Ratings, Structured Finance Ratings, Sustainability Ratings, and Sovereign & Regional Government Ratings

Technology organisational units are represented by the Digital Transformation Service.

Operations organisational units include:

- Commercial Service

- Economy & Finance Service

- Legal Support Service

- Personnel & Administrative Support Service

- Asset Protection Service

- Internal Control & Risk Analysis Service

Key activities

Our Values and Advantages

Adherence to the principle of independence

The Agency makes sure that its rating activities are strictly in line with the requirements of the federal legislation and international regulatory best practices.

Preventing external influence on assigned ratings and independence of the Agency’s opinion | Keeping the activities of the Rating Service, the Methodology Department and the Validation Department separate from each other | Maintainting firewall between analytical and commercial services |

|---|---|---|

The rating process guards against the influence of government institutions, governance bodies or owners. Expert RA’s equity holding structure fully aligns with the regulator’s current requirements and excludes potential conflicts of interest in carrying out any rating actions | The Methodology Department is independent from the Agency’s analytical and other services and ensures that the rating methodologies are adopted and reviewed/adjusted, and that the Rating Service is consulted regarding the use of rating methodologies in their rating process. The Agency’s standing Validation Department, independent of other business units, enables the quality control of existing methodologies | The business process architecture, the purpose-built and implemented information systems and the firewall principle play their roles in creating a reliable administrative and technological barrier between the analytical and commercial services, preventing them from influencing one another |

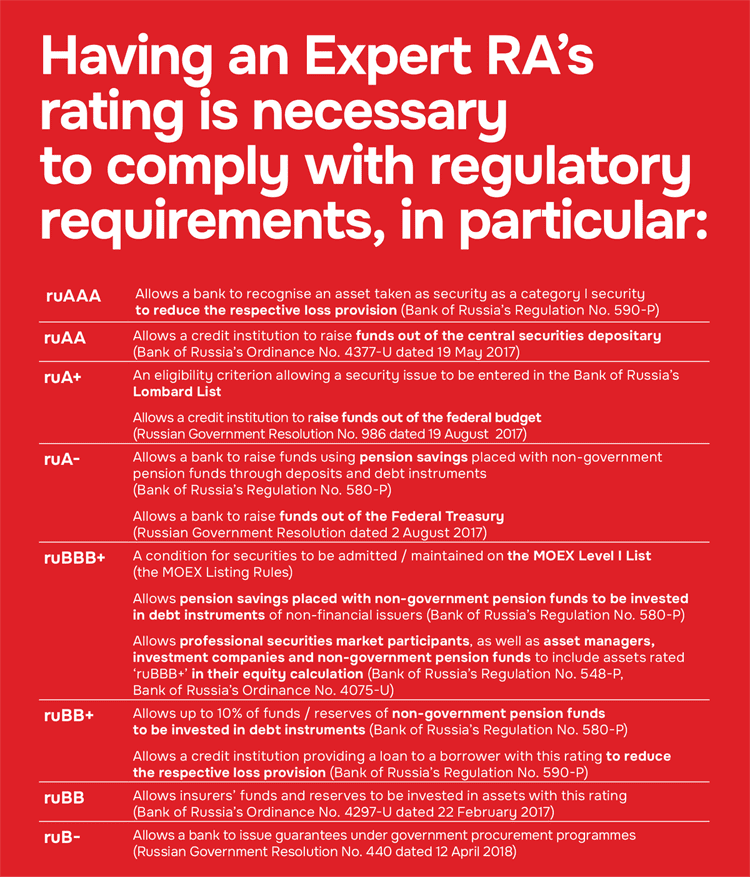

Regulatory use of ratings

Debt instruments | 372 |

Non-financial companies | 176 |

Banks | 142Including the Republic of Belarus. |

All-lines insurers | 38 |

Constituent entities of Russia | 24 |

Leasing companies | 28 |

Holding companies | 15 |

Financial companies | 13 |

Life insurers | 13 |

Non-government pension funds | 12 |

Microfinance institutions | 15Including the Republic of Kazakhstan. |

Project companies | 5 |

Factoring companies | 5 |

Depositories | 2 |

To see the full list of statutory documents regulating the use of ratings, click here.

Rating Methodologies

ESG Leadership

Expert RA operates in accordance with:

- UN Sustainable Development Standards

- ICMA’s Sustainability-Linked Bond Principles; LMA’s Sustainability-Linked Loan Principles

- Russian Federation Government’s Decree No. 1587 dated 21 September 2021 “On Endorsing the Criteria for Sustainable (Including Green) Development Projects in the Russian Federation and Requirements for Verifying Sustainable (Including Green) Development Projects in the Russian Federation”

- Regulation of the Bank of Russia No. 706-P dated 19 December 2019 “On the Standards for Issuing Securities”

Also, we are among the signatories to the Principles of Responsible Investment (PRI) https://www.unpri.org/ .

Topic | 2022 | 2023 |

|---|---|---|

ESG ratings | 12 | 19 |

Green bonds | 12 | 13 |

Social bonds | 11 | 12 |

Adaptation (transition) bonds | 1 | 1 |

Social concepts | – | 1 |

Governance Quality Rating | 5 | 5 |

Expert RA is on top of the impact ranking of rating agencies produced by the INFRAGREEN analytical platform. In 2022 and 2023, it was an absolute leader by the number of verifications, solicited ESG ratings, published ESG ratings, sustainability-themed analytical products, and organised issue-related events.